Welcome to theustales.com.

Hey, excited investor! Today, November 10, 2025, marks a big day for everyone who bid in the Groww IPO. The wait ends now. Share allotment gets finalized this evening. Imagine checking your phone and seeing those shares in your demat account. Let’s dive into everything you need to know – from status checks to listing buzz – in simple words.

What Happened with Groww IPO Subscription?

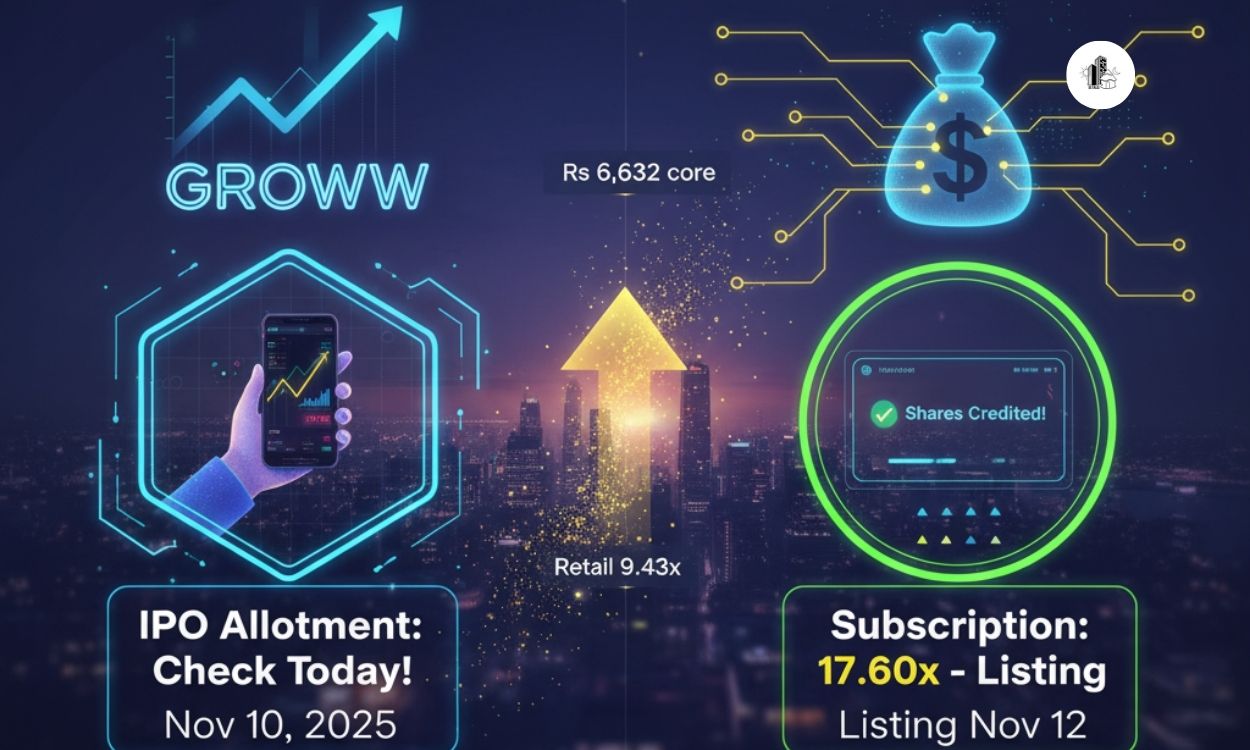

Groww’s parent, Billionbrains Garage Ventures, launched a massive Rs 6,632 crore IPO. It opened on November 4 and closed on November 7. Investors loved it. The issue got subscribed 17.60 times overall.

Bids flooded in for 641.87 crore shares, but only 36.48 crore were available. Qualified Institutional Buyers (QIBs) led with 22.02 times. Non-Institutional Investors (NIIs) followed at 14.20 times. Retail folks like you and me subscribed 9.43 times. This strong demand shows trust in Groww’s future.

The IPO mixed fresh shares worth Rs 1,060 crore and an offer for sale of Rs 5,572 crore. Big names like Peak XV Partners, Ribbit Capital, Tiger Global, and Sequoia sold shares in the OFS. Groww raised Rs 2,984 crore from anchor investors before opening. Global and domestic funds jumped in early.

You may Also Like:

Where Will the Fresh Money Go?

Groww plans smart use of the new funds. First, Rs 225 crore goes to brand building and marketing. Next, Rs 205 crore strengthens its NBFC arm, Groww Creditserv Technology. Then, Rs 167.5 crore funds margin trading at Groww Invest Tech. Additionally, Rs 152.5 crore upgrades cloud infrastructure. The rest supports acquisitions and daily operations.

This strategy boosts growth. Groww already acquired Fisdom for Rs 960 crore. The deal awaits approval but expands into wealth management.

Groww: The Simple Investing App Everyone Loves

Groww started in 2017 in Bengaluru. It makes investing easy for retail folks. Users trade mutual funds, stocks, F&O, ETFs, IPOs, digital gold, and U.S. stocks. The app’s clean design wins hearts. Moreover, in-house tech keeps costs low and updates fast.

Groww holds over 26% market share in retail broking. It boasts 12.6 million active clients as of June 2025. Revenue streams include brokerage fees, mutual fund distributions, and product commissions. The broking arm turned profitable through efficiency.

Backers like Peak XV, Ribbit, Tiger Global, and Y Combinator fueled early growth. Now, digital platforms capture 76-78% of active NSE clients.

Today’s GMP and Listing Expectations

Grey market premium stands at Rs 4 today. At the upper price band of Rs 100, shares may list at Rs 104. That’s a 4% gain. GMP dipped from a high of Rs 16.70. Yet, analysts predict modest gains. Strong QIB interest and user growth support this.

Listing happens on November 12 at 10 AM on BSE and NSE. Excitement builds for the debut.

How to Check Allotment Status – Step by Step

Don’t wait. Check your status easily. Use these methods once finalized.

MUFG Intime India (Registrar)

- Visit https://in.mpms.mufg.com/Initial_Offer/public-issues.html or https://www.linkintime.co.in.

- Select Billionbrains Garage Ventures (Groww).

- Choose PAN, Application Number, DP/Client ID, or Account Number.

- Enter details and submit.

- See results and refund info if needed.

BSE Website

- Go to https://www.bseindia.com/investors/appli_check.aspx.

- Pick Equity as issue type.

- Select Groww IPO.

- Enter Application Number or PAN.

- Complete captcha and search.

NSE Website

- Head to https://www1.nseindia.com/products/dynaContent/equities/ipos/ipo_login.jsp.

- Sign up with PAN if new.

- Log in with credentials.

- Check allotment on the page.

Or try https://www.nseindia.com/invest/check-trades-bids-verify-ipo-bids. Select Groww, enter PAN and application number, then submit.

Refund and Demat Credit Timeline

No shares? Refunds start tomorrow, November 11. Money returns to your bank. Got allotment? Shares credit to demat on November 11 too. Everything moves fast.

Expert Views on Valuation

SBI Securities calls it a strong player. At Rs 100, P/E hits 33.8x FY25 EPS. Revenue and PAT grew 85% and 100% CAGR from FY23-25. They say subscribe at cutoff.

Bajaj Broking notes P/E at 29.9x FY25. The app shines for mutual funds and more services like MTF and algo trading.

Angel One sees P/E at 40.79x post-issue. Valuation looks steep versus peers. They rate neutral for long-term.

India’s Booming Investment Scene

India’s wealth market stands at Rs 1.1 lakh crore now. It may reach Rs 2.2-2.6 lakh crore by 2030. More people join demat accounts – only 16-18% adults have them. Active broking penetration is 5%. Huge room to grow, says Canara Bank.

Digital platforms simplify access. Groww leads this change with transparency and tools.

Why Groww Stands Out

Groww’s cloud tech handles heavy trades. It rolls out updates quickly. The UI feels friendly on app and website. One platform meets all needs – from beginners to pros.

In-house stack cuts costs. It reacts fast to rules and user feedback. This edge drives expansion.

Groww turns profitable despite marketing spends. Operational smarts help.

The fintech sector thrives. Groww’s IPO reflects confidence in digital investing.

Today wraps the allotment phase. Check status soon. Tomorrow brings refunds or credits. Wednesday? Listing day!

Groww democratizes wealth. From mutual funds to U.S. stocks, it simplifies everything. With 17.6x subscription, the hype is real. Stay updated – your investment journey continues.

FAQs

- When does Groww IPO allotment finalize? It finalizes today, November 10, 2025, by evening.

- How can I check my Groww IPO status? Use MUFG Intime, BSE, or NSE websites with PAN or application number.

- What is the Groww IPO listing date? Shares list on November 12, 2025, at 10 AM on BSE and NSE.

- What is today’s GMP for Groww IPO? GMP is Rs 4, suggesting a Rs 104 listing price.

- When do refunds and demat credits happen? Both start on November 11, 2025.

- How much did Groww IPO raise? It raised Rs 6,632 crore total, with Rs 1,060 crore fresh issue.